Wolf Crypto ICO Review: COTI

COTI: Blockchain 3.0 Proof of Trust DAG, Internal Exchange & Payment DApp

When we first looked at COTI back in May of 2018, it was relatively basic decentralised payment app being built on top of Ethereum, looking to raise funds from a pure utility token sale with a core value message of ‘solving the downfalls of traditional payment systems, namely, high fees and low approval rates’. Traditionally we have tended to avoid pure DApps as investments and have instead focused on platforms and protocols, as they have not only provided the better return for investors but also add more value to the overall crypto ecosystem. So the question at the time regarding COTI was, why use a payment token on top of Ethereum when you can just use ETH?

COTI recently again came to our attention after winning a startup pitch competition with Google and another pitch competition with Ian Balina. Thankfully, in the time that has past they realised “blockchain in its current form was an inadequate tool and like many others in the industry, we took note of unsolved challenges of scalability, high fees and the lack of buyer-seller protections”. This has resulted in a pivot from a basic payment token and DApp on Ethereum into a fully fledged payment platform, inclusive of a DAG, bespoke Proof of Trust consensus protocol, internal exchange and stable coin, on top of the existing payment DApp.

To match the tech pivot, COTI also now has an updated roadmap and sales structure, including a reported equity offering with a bonus issuance of utility tokens (details of the equity offer have not been made public yet, one would assume this would give investors an ongoing royalty in transaction fees across the COTI platform along with a stake in the overall company).

The change in structure is described in detail in the article below —

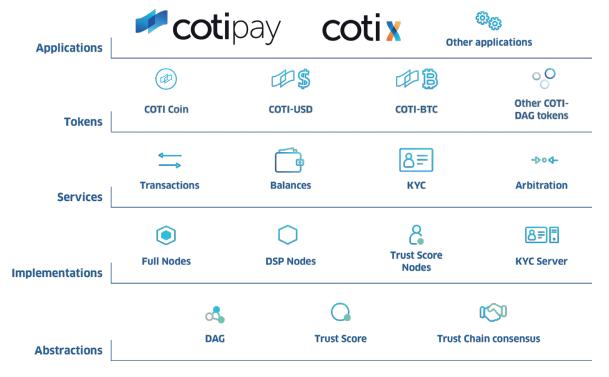

As per the article above, the COTI platform now comprises of three distinct components.

1 — Trustchain

The Trustchain is a proof of trust (PoT) blockchain consensus algorithm built on DAG technology. DAG stands for Directed Acyclic Graph and by design eliminates the scaling and speed issues traditional ledger based blockchains face. At its most basic level this is due to the way data is handled on each.

On a ledger based blockchain, each time new data is written to the ledger it is appended sequentially to the end of the chain in the form of a new block and processed by proof of work (PoW) mining transactions. This means that over time, as a ledger blockchain has more activity, the size of the chain continues to grow, resulting in a bottleneck to scalability based off increased storage and processing demands. Transactions on a PoW blockchain are only confirmed once a new block is written to the chain, meaning there is an ever present delay in the submission of a transaction and a confirmation of the transaction.

On a DAG, instead of being written sequentially and as a block of data to a chain, data is transferred in topological order and without the use of a block, relying instead on a series of nodes to validate two previous transactions. Nodes must solve a cryptographic validation puzzle like a PoW miner would before it can issue a new transaction. In this sense nodes become the “miners” of the network but without the overhead (dedicated hardware and electricity costs) of miners on a PoW network. This structure eliminates the need for a ledger and the bottleneck a ledger introduces. The main benefit of a DAG past reduced overhead is that transactions on a DAG become instantaneous and extremely low cost. A key point to note that unlike a ledger based blockchains, the more nodes and use of nodes involved in a DAG, the faster it becomes.

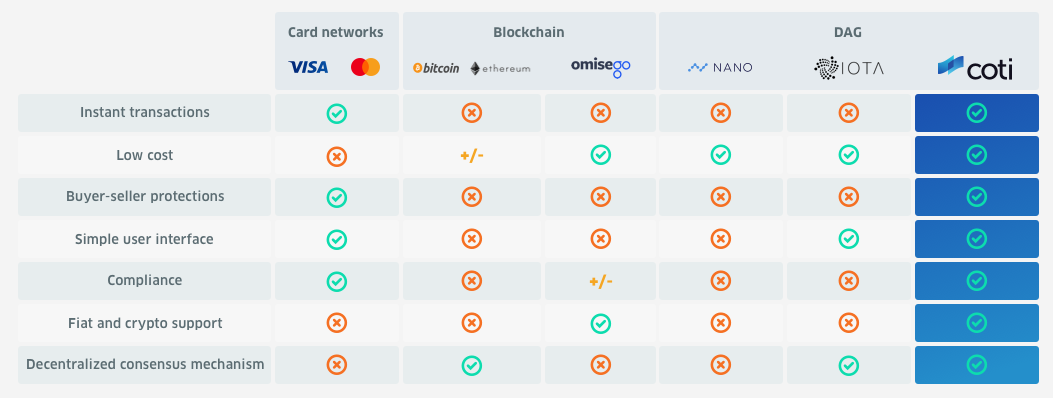

As some examples of existing DAG tech currently on the market, the best known DAG is IOTA and it’s “tangle”. NANO is another DAG project that has gained some traction (despite a series of controversies). Spacemesh is another project who recently raised 15M USD in seed and is building on DAG technology.

The differences between ledger based blockchains and DAGs are far more in depth than the simplistic explanation above and are explained in comprehensive detail by the good folks at CoinMonks.

The COTI Trustchain has several unique components as compared to other DAGs, focused around its objective as an end-to-end payment solution looking to target mainstream adoption by enterprise, government and merchants.

- Proof of Trust (PoT) Algorithm

The key piece of technology that separates COTI from other DAGs. COTI have has developed a unique PoT algorithm in which participants in the network are assigned a Trust score. A participants initial trust score is determined by a general questionnaire and document verification at the point of sign up. Once on the network, further trust scores are calculated by, account balance, dispute occurrence, disputes won, disputes lost and user ratings. These combined factors are what create a participants rolling trust score.

Trust Scores also serve as a key driver of transaction fees: higher scores are associated with low to zero fees, while low scores are associated with comparatively higher fees. In this sense, participants on the network are fully incentivised to maintain grow and maintain high trust scores.

- Double Spend Protection (DSP) & Consensus

DSP Nodes will be geographically distributed to a number of clusters. All DSP Nodes in a cluster will be strongly connected to each other as before, and a specific protocol for cross-cluster synchronization will be implemented.

The COTI DSP solution consists of adding a handful of highly trusted Nodes to the network with only one function: to reach consensus on whether the transaction is legitimate or a double spend. Transactions require the signature of a DSP Node before they can be considered fully confirmed, while any detected double-spending attempts are flagged and refused.

- Buyer Seller Protections

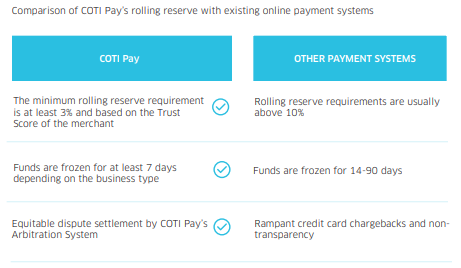

COTI offers a ready-to-use service users can appeal to in cases of fraud or any other dispute related to deals settled through the COTI payment system. The Arbitration Service creates a rolling reserve for each merchant to cover possible claims and a system-wide Reserve Credit Fund (RCF) to guarantee it. Both funds are maintained in the COTI coin. The required merchant rolling reserve is calculated based on the merchant’s Trust Score.

COTI currently have an alpha version of their Trustchain running and users can register to join the alpha as a node participant below. The alpha allows the ability to open a wallet, generate a seed and send transactions while seeing them appear LIVE on COTI’s Cluster.

COTI have also made the code for alphanet publicly available on Github for code review. They state a TPS of 10K on the alpha version of Trustchain. This is expected to scale past 100K TPS and is “almost infinite” once put into production and more participants join the node network. These claims are made in the following video—

More details on the COTI Trustchain can be found below —

Full details can be found in the Trustchain Technical Whitepaper.

So what do these features actually mean in the real world?

One of the main points of contention when it comes to mass adoption of crypto is scalability. At 10K TPS and scaling upwards from there, on a purely transactionary level, this not only puts COTI on par and above other cryptocurrenices, but critically it allows them to compete directly (and outperform) PayPal (193 TPS), Visa (24K TPS) and Mastercard. Unlike other cryptocurrencies facing scaling issues, this also means that with this critical element already solved and implemented, COTI can focus on the business development of actually getting merchants and consumers on-boarded and using the platform.

Double spend protection is also an important aspect of an crypto platform. On a traditional PoW ledger based blockchains like Bitcoin, this is known as the 51% attack and can occur when a group of miners control 51% of the hashpower of the network, effectively allowing a user to send or spend the same bitcons twice, hence the name double spend. This is slightly different on a DAG, in which nodes validates other nodes last two previous transaction in order to allow future transactions, however the end result remains the same. IOTA has faced some conjecture over it’s attempts to prevent double spend on their tangle. With the addition of specific double spend nodes on top of the full nodes running the Trustchain DAG, COTI have managed to side step this issue without sacrificing any speed or scalibility.

The point of competing with Visa and Mastercard is an important one. Again, in the conversation of adoption, crypto suffers as transactions on crypto networks are non-refundable, a definite factor when it comes to trust and utilisation of payment systems. By introducing the Arbitration Service into the COTI platform, this allows the same level of Buyer/Seller protection offered by the likes of PayPal, Visa and Mastercard, removing a critical point of comparison and barrier of entry to both consumers and merchants alike.

2 — COTI-X

COTI-X is an internal interoperability exchange and settlement layer on the COTI platform, serving three man purposes —

- Enabler of cross-currency payments

- Direct transfer of one currency to another

- Enables liquidity on the COTI platform

Unlike a traditional exchange, there is no open order book for the exchange of coins, instead there is a fixed price for each presented, with currency exchange requests fulfilled automatically. Think a scaled down ShapeShift (but without the exorbitant fees ShapeShift charge).

COTI-X also acts as the KYC/AML layer of the COTI platform. It seems the idea here is that to compete with the likes of PayPal, Visa and Mastercard, you need to be as compliant as them. Fair call. Since users are KYC’ed upon entry to the COTI platform, this also eliminates any conjecture around money laundering that other crypto platforms face when compared to traditional payment solutions.

3 — COTI Pay

COTI Pay is the flagship application on the COTI platform offering the following features for consumers and merchants alike —

Consumers

- Debit Card

COTI are offering a debit card that connects directly into the COTI Pay wallet, allowing users to interact with non-crypto payment solutions, i.e a user could purchase an item from eBay, checkout with PayPal and use their COTI debit card to pay for the transaction, with COTI coins being automatically deducted from the COTI Pay wallet.

Considering this is the entire value offering of a project like MCO, who raised $26.7M and now has a marketcap of $69M, this seems like a very strong offering, however its currently unclear in available resources at what stage and regions these cards will be made available for consumers.

Since COTI-X allows the exchange of crypto to fiat and crypto to crypto, consumers paying for goods in foreign currencies will automatically have these foreign conversions converted at COTI’s end, removing any third-party currency exchange fees.

- Peer-to-Peer Transactions

As it sounds. Users will be able to transfer coins supported on the COTI platform instantly to others users. Based off the users trust score, this will be either free or at very low cost.

- Wallet-to Wallet Transactions (think NFC, touch and go style payments/transfers)

Like the Tap and Go services credit card and Apple offer, COTI Pay users will be able to instantly transfer funds when in close proximity.

- Exchange Digital and Fiat Currencies

Using COTI-X, COTI Pay users will be able to exchange crypto-to-crypto, crypto-to-fiat and fiat-to-crypto directly from the COTI Pay wallet. This is facilitated by the COTI-X layer of the platform.

Merchants

- Point of Sale (POS)

COTI offers a full POS software suite that seamlessly integrates with COTI Pay. By utilizing the COTI POS, merchants will benefit from all COTI Pay advantages, while also being able to accept normal credit and debit card transactions. All that is required at the consumer and merchant end is access to the application on a mobile device to facilitate payments.

This seems to be in line with where most other POS systems are headed, with less reliance on the issuance of physical hardware, instead relying on the use of a consumer or merchants existing mobile device. From an adoption standpoint, this makes it much easier for both sets of users to just ‘pick up and go’ and start using the technology.

- Processing Tools

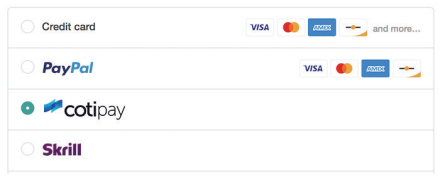

COTI Pay is developing processing tools that will enable merchants to start accepting payments from COTI Pay wallet holders. Consumers who visit COTI Pay-powered merchants’ websites, but don’t have a COTI Pay wallet will be invited to open a wallet as part of the checkout process (think how the PayPal checkout process works). Merchants will be able to choose whether they wish to connect to COTI Pay’s payment rails via API or by embedding an iFrame into their websites.

COTI Pay merchants will have access to a dashboard that provides detailed data and reporting functionality on their COTI Pay transactions. Within this dashboard, merchants will choose which COTI Pay-supported currencies they wish to accept, as well as their preferred settlement currencies. The dashboard will also provide merchants with wallet-like functionality that enables them to make payments to COTI Pay wallet holders and to other COTI Pay-powered merchants, as well as the ability to use COTI-X’s facility to exchange currencies.

- Whitelabel Solution

Developers can create white-labelled tokens, payment apps, dashboards etc for their specific use cases. This allows service providers to deploy their own payment network on top of COTI infrastructure, dramatically reducing deployment time and using the integration tools already built and rolled out by COTI.

If the COTI platform gains usage and adoption, this has real potential for full network effect. This would essentially give any retailer the ability to issue their own branded token and payment app, and open up potential markets that are not accessible to traditional payment processors. In a world in which money is becoming fully digitised and everything is about branding, the ability to quickly spin up an enterprise level branded digital payment token and processor, while leveraging the ability that cryptocurrency offers, decentralised, low cost, borderless transfers of value would be extremely appealing to many.

Arbitration System — Protection for Consumers and Merchants

This is the biggest point of difference between COTI and other crypto payment platforms, and the one that lends it best to actual adoption is the buyer seller protection.

- Billing Errors

- Inadvertent Transfers

- Unauthorised Charges

- Undelivered Goods or Services

- Non-conforming Goods or Services

Of course, the arbitration system also introduces new participants into the platform in the form of mediators. Unlike a PayPal style dispute resolution system, in which PayPal makes the determination (and in 99% of cases sides with the buyer, be it the wrong or right decision), arbitration on COTI is fully decentralised, with three mediators chosen to view the facts of the matters and vote on a resolution. Mediators are rewarded in COTI coins for their contribution to the process.

As per the Roadmap, the COTI Pay beta has been released in Q4 2018. Users can join the beta by signing up for COTI Pay here.

More details on COTI Pay can be found in the COTI Pay Overview Document.

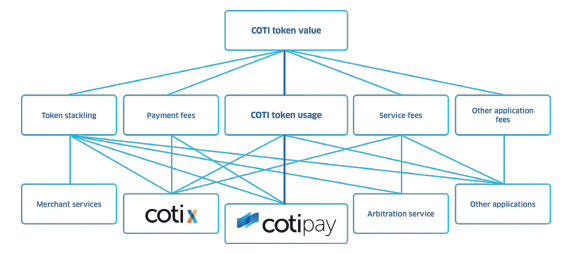

Token Utility

The COTI token economy is powered via two coins, COTI and COTI Dime.

- COTI Coin

COTI coin will be used as a means to pay fees, arbitrators and node operators utilising the COTI protocol. The COTI coin will exist outside the COTI platform (i.e on exchanges) and will be tradable for COTI Dime and vice versa on the COTI platform itself, via COTI-X.

Node operators will be awarded a percentage of the transactions that are processed through the node. For nodes that stake 10K COTI coins and run for a year, COTI will additionally award the node operator with 100K COTI coins.

Arbitrators who help resolve buyer seller disputes will also be awarded COTI coins for their efforts. It is unclear what these rewards are at this point in time. One would also assume arbitrators are also required to stake some amount of COTI coins.

Merchants who wish to use COTI as a payment solution will also need to stake COTI coins in a rolling reserve tied into their account. This will be based off a combination of the merchants turnover and trust score and at a minimum will be set at 3%, continuously locking COTI coins from the overall circulating supply. COTI itself will maintain a Reserve Credit Fund that guarantees merchant reserves, further locking tokens from circulating supply.

- COTI Dime

COTI Dime is a generic price-stable coin pegged to USD 10 cents. The COTI Dime coin exists only within the COTI platform and serves as a price stabilisation method ensuring usability for everyday and mainstream use by merchants.

This coin fuels the interaction fuels the interactions between consumers and merchants., i.e consumers purchase goods from merchants on the COTI platform using the COTI Dime, allowing for items to be priced in “real” dollars instead of as a fluctuating token price. The peg is instead COTI coins per COTI Dime as opposed to COTI coins per Item price.

It seems like every man and his dog are offering stable coins of late, so when looking at COTI’s Dime, the natural question is, what makes it any different than the rest? The main point of difference here is that a majority of stable coins are built on Ethereum, and thus suffer from some of the transactional issues that can occur on the ETH network. With the COTI Dime being based on their instantaneous DAG, this removes a friction point, after all, who wants to be standing at the counter of a coffee store for minutes while waiting for an ETH transaction to confirm before you can leave?

More details on the COTI token economy and utility models can be found in their Token Economy whitepaper.

Token Metrics

The COTI hardcap is 30M for 30% of tokens. With 15M raised in the first round of funding, this leaves 15M remaining. As mentioned earlier, this is reported to be in the form of a mixed equity plus bonus utility token offering. While this is on the low end of token distribution for the token sale, it is important to note that 45% of all tokens will be allocated to the incentive and liquidity reserve and used to incentivise consumers, merchants, partners and node operators to join the COTI platform. The incentive program is talked about in more detail in the Roadmap section below.

Note, we would prefer to see a more detailed breakdown of what percentage of the 45% of tokens is dedicated towards incentives and what percentage is dedicated to liquidity.

15% of tokens are allocated to the team, locked for six months and then vested quarterly over the next 18 months. A six month lockup for team tokens is pretty poor, ideally we like to see 1–2 year lockups for team tokens, showing long term confidence in the project.

10% of tokens are allocated to advisors and will remain locked for at least six months. Again, these are locked for 6, 12 or 24 months, ideally it would be good to have more clarity around this also, how many tokens are unlocked at each stage?

COTI coins are created during the network’s genesis transaction, which makes COTI a fixed-supply DAG-based cryptocurrency. Following the network’s inception, there is no possibility to create or destroy COTI tokens as there are no mining activities associated with the COTI network. 2B COTI coins will be distributed during the launch of the main net in Q1 2019.

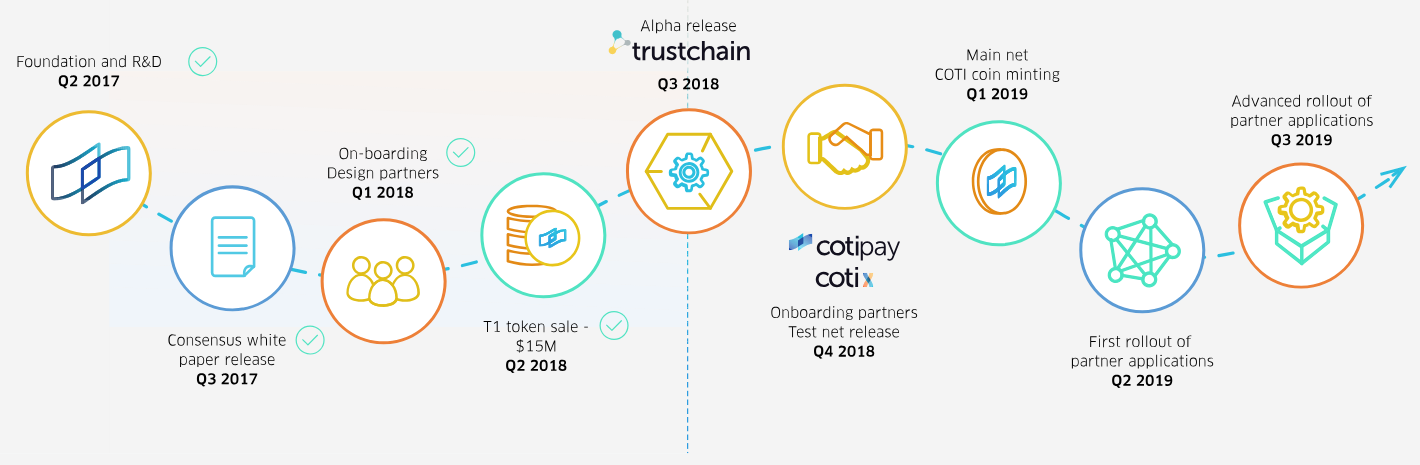

Roadmap

The COTI roadmap is indicative of the changing structure of their tech and funding strategies. In Q2 2018 COTI raised 15M, giving the project an assumed runway of approx two years. Impressively COTI have already delivered the Trustchain Alphanet and have the COTI-X and COTI Pay beta dropping in Q4 2018.

COTI will begin onboarding customers and merchants to COTI Pay and COTI-X during the beta phase, meaning once mainnet is live there will be active users at both ends on the platform from the start. Q2 2019 will signal the onboarding of ‘partner applications’, one would hope this is the likes of processing.com or other whitelabel solutions that will significantly drive usage and adoption of the platform.

Mainnet is scheduled for Q1 2019. Once mainnet is up and running COTI have in place an aggressive adoption plan to on-board users to the platform, with tokens for this coming from the afore mentioned Incentive and Liquidity Reserve, consisting of 45% of all tokens.

In terms of adoption, it’s encouraging to see an ICO with a plan of how to get users onto their platform, instead of taking the view of if we build it, they’ll come, and automatically assuming adoption. With a referral program in place for all participants in the platform, and with ‘over 5000 merchants applications, and 80,000 users have already requested to download our wallet” this serves as a ideal base to further extend these numbers.

With a great deal of the tech mostly built out, one would assume that a significant portion of these new funds will be used for actual business development, something a majority of crypto projects are severely missing.

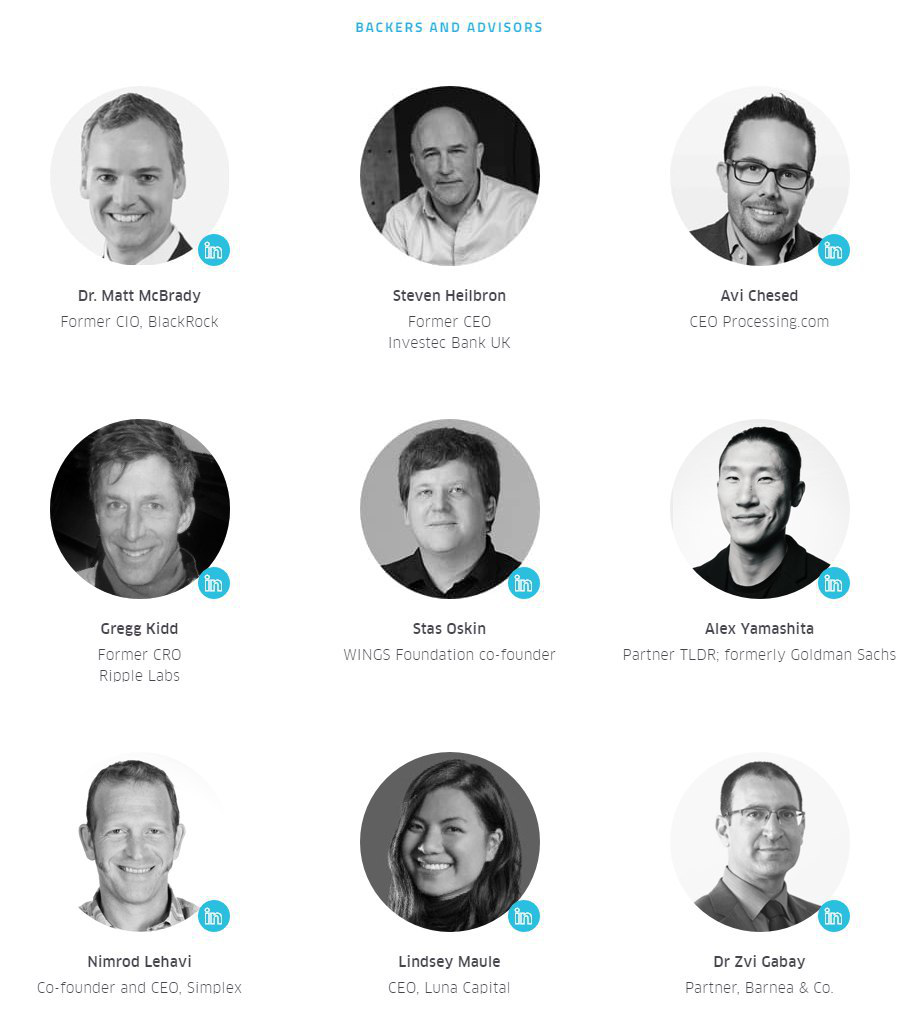

Team

The core COTI team sits at an impressive 22 members. Too many to list individually for the purposes of this review.

The team seems to have grown significantly on the R&D side since deciding to build their on DAG, boasting 15 engineers and most impressively lead by Dr. Nir Haloani, who lead the research team into RTC (Real Time Compression) at IBM, after selling his previous company, in which he developed 13 patents relating to data compression. Quite the heavy hitter.

Key team members of note are —

A full list of all team members can be found on the COTI website — https://coti.io/en/team.html

COTI also boasts a strong team of advisors, being backed by advisors from the likes of BlackRock, Processing.com, Ripple Labs, Wings and Simplex, among others. For a project that is payment based, it’s encouraging to see advisors who have the ability to help drive adoption and have previous payment and banking experience.

COTI has several industry partnerships, some of more note that others. Bancor and processing.com are the cream of the crop. Ideally this would be strengthened with several more partners looking to utilise COTI’s technology.

The project has also been well supported at a VC level, though some of the advisors on the project come from the VC’s themselves. One positive of this is that by being both investors and advisors, they should be more incentivised to actually deliver on the platform. Hopefully it’s a case of “skin in the game” or “putting their money where their mouth is”.

Summary

One of the key conversations in crypto lately has been that of adoption. As crypto has moved past the pure speculation stage, users in the crypto ecosystem are looking to projects that actually have a point of difference, an adoption plan (rather than a build it and they’ll come plan) and actual technology.

It’s refreshing to see that despite raising a significant amount of money early on in the good old days of utility tokens, COTI have moved with the times and instead of delivering a basic product and utility case, have actually expended their vision, despite the bear market, into a fully fledged platform lending more to enterprise and actual adoption, with a heavy emphasis on incentivised real world business development.

In the niche COTI are looking to target, its obvious there is a demand for a product, as to be fair, the main point of crypto currency at this point in time is a store or transfer of value. The question is, is it better than other offerings out there? In a world in which the purest tech does not always ‘win’ (lets face it, if that were the case, we’d all be using Bitcoin already), it’s important to providing a compelling use case for the ordinary man, and in many ways COTI’s offering stacks up (and at times excels) when compared to the likes of PayPal, Visa and Mastercard, providing the same level of ability as each service offers, while reducing some of the overly complex friction and entries points that apply to other forms of cryptocurrencies.

TLDR Summary;

- Pivot from ERC20 based token and Ethereum payment DApp to Proof of Trust DAG platform with native coin, stable coin and internal exchange.

- Aggressive expansion of team to accommodate new goals.

- Additional 15M raise with equity and bonus token issuance.

- Release of AlphaNet of Proof of Trust DAG.

- Release of code to Github for peer review.

- Release of COTI Pay beta, future release of debit card and additional COTI Pay features.

- Focus on enterprise level adoption, including arbitration system for consumers and merchants, merchant tools including POS, processing dashboards and whitelabel solution for bespoke implementation.

We have rated COTI at 86.70% in our blockchain project review sheet.

For more info visit our Telegram channel dedicated to Wolf Crypto Blockchain Project Reviews: https://t.me/WolfCryptoICO

Please note, the thoughts and opinions in this article are those of the writer and in no way should be considered financial advice.

Wolf Crypto Resources

Website: https://wolfcrypto.net/

Public Group: https://t.me/WolfCryptoPub

News Channel: https://t.me/WolfCryptoAnnounce

Blockchain Project Reviews: https://t.me/WolfCryptoICO

Twitter: https://twitter.com/WolfCryptoGroup

Public Group: https://t.me/WolfCryptoPub

News Channel: https://t.me/WolfCryptoAnnounce

Blockchain Project Reviews: https://t.me/WolfCryptoICO

Twitter: https://twitter.com/WolfCryptoGroup

by ; wanda11

link: https://bitcointalk.org/index.php?action=profile;u=2690432

Komentar

Posting Komentar